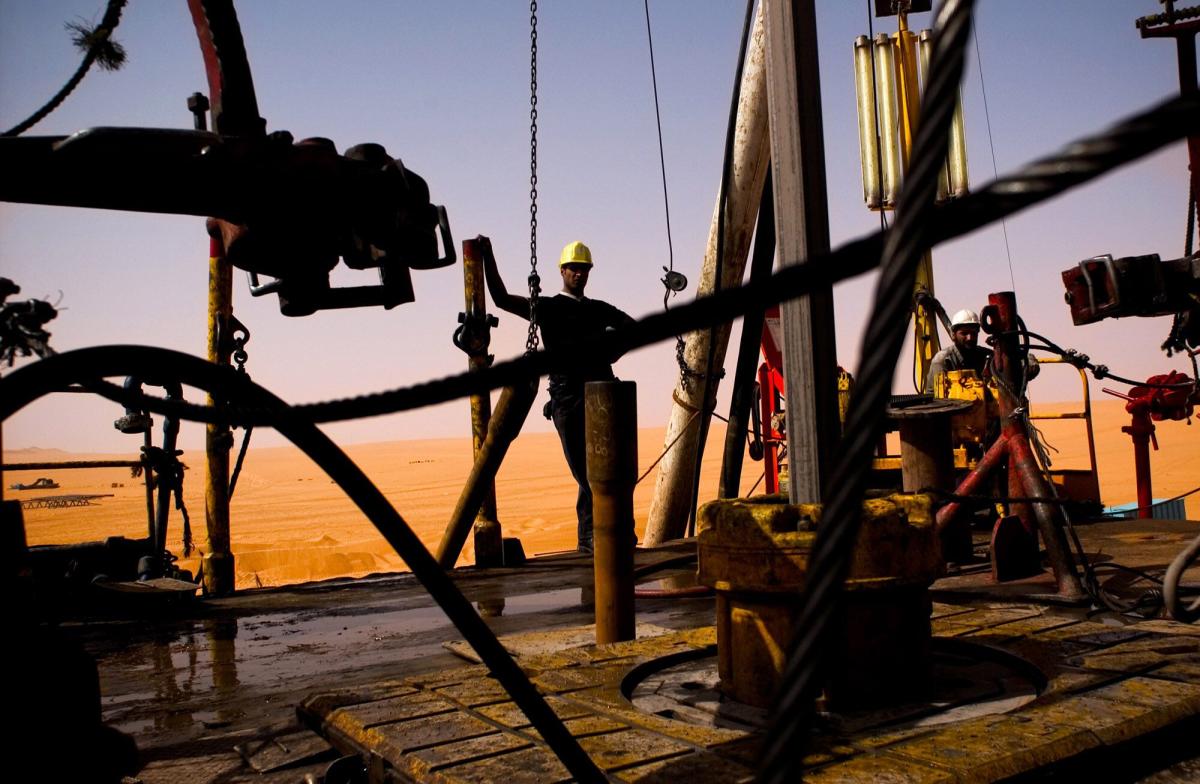

Oil declined as disappointing Chinese economic data and a resumption of Libyan production undercut signs of a tightening market.

West Texas Intermediate slipped to near $74 a barrel and closed at the lowest price in a week on Monday after protesters left Sharara, one of Libya’s biggest oil fields, allowing production to restart. Meanwhile, China’s economy expanded more slowly than expected in the second quarter, though apparent oil demand grew 14% last month from a year earlier.

Crude remains lower this year as China’s lackluster recovery and the Federal Reserve’s rate hikes weigh on demand. US central bank officials are expected to raise borrowing costs again this month, and have signaled they’re still open to further increases later in the year.

Yet oil has rallied the last three weeks on signs the market is finally tightening, with OPEC+ heavyweights Saudi Arabia and Russia both reducing crude exports. Those curbs, along with the outages in Libya and an ongoing supply disruption in Nigeria, had helped Brent to briefly surpass $80 a barrel last week.

Oil’s recent rise has meant the price of Urals crude exported from Russia has exceeded the $60 price cap set by the Group of Seven to curtail Moscow’s revenue. That’s likely to add banking and shipping woes to buyers including India and China, with one protection and indemnity provider already flagging that shippers of Russian oil can expect delays.

Source : Yahoo Finance

Add Comment